Share this @internewscast.com

In the late 1950s, the married acting duo Lloyd and Dorothy Bridges acquired a beachfront property along the scenic Pacific Coast Highway. While the exact purchase price remains a mystery, similar Malibu homes during that era were valued between $40,000 and $50,000. If we assume they paid the upper range of $50,000, it would equate to roughly $550,000 today. Lloyd passed away in 1998, followed by Dorothy in 2009.

After Dorothy’s passing, the property was inherited by their three children: Jeff Bridges, Beau Bridges, and their sister Lucinda. By that time, the value of the four-bedroom house had soared into the millions.

Owning a shared property can pose its own challenges. Questions arise like who gets to celebrate Christmas there or enjoy the summer? Can children and grandchildren drop by anytime they like? Jeff and Beau, having amassed their own wealth through successful acting careers, likely didn’t need the financial gain. While little is known about Lucinda’s financial status, let’s assume she wasn’t as wealthy. In such scenarios, a common and practical solution is to turn the property into a rental income source, thereby avoiding personal use.

This strategy is precisely what the Bridges siblings implemented. For years, they rented out the beachfront residence at rates of $16,000 during the off-season and $25,000 in the summer, potentially generating an estimated $200,000 annually. Divided among the three, each sibling could earn approximately $67,000 annually, all without any effort.

With no mortgage to worry about, the property likely required minimal maintenance. The most significant expense would have been their yearly property tax obligation. However, due to a somewhat contentious California tax regulation, their annual property tax was a mere $5,700. Not monthly, but $5,700 per year. Essentially, just 11 days of rental income could cover this cost.

California Tax Codes

This benefit is thanks to California Proposition 13, a law that limits property taxes to 1% of the assessed value and restricts annual assessments to a 2% increase unless the property is sold.

In 1986, voters passed California Proposition 58, allowing parents to transfer primary residences to their children without triggering reassessment. In many cases, that meant heirs could continue paying property taxes based on valuations set decades earlier.

Consider this hypothetical example – Let’s say your grandparents bought a two-acre undeveloped property along Lake Tahoe for a penny in the 1940s. They built a cabin, then a main house, then another small house to create a nice little family compound that became the emotional center of your extended family, hosting weddings and reunions and more. Now, let’s say the state assesses the value of this Tahoe property at $30 million based on recent comparable sales when it is inherited by you, your two siblings, and three cousins. You, your two siblings and three cousins would have to collectively earn $600,000 pre-tax every year to pay that one bill. That’s $100,000 per person. What if cousin Timmy in Florida can’t hold down a job, let alone chip in $100k a year for a Tahoe house he never visits? It gets complicated and messy fast. The 1986 law – Prop 58 – was passed specifically to prevent families from being forced out of properties they owned for generations.

Critics see something else.

They see a system where two families living next door to each other can pay radically different tax bills purely because one bought in 1965 and the other bought in 2025. They see heirs renting out multimillion-dollar properties while contributing a fraction of what newer homeowners pay toward schools, police, fire protection, roads, and libraries. In Los Angeles County, inherited properties like the Bridges home became emblematic of what some lawmakers called a “two-tiered” tax system.

The backlash eventually led to reform. In 2020, California voters approved California Proposition 19, which significantly narrowed the inheritance benefit. Under the new rules, children who inherit a home must use it as their primary residence to retain limited tax advantages. Rental and second homes generally lose the old shield and are reassessed at market value.

Importantly, Proposition 19 applies prospectively. It does not retroactively reassess properties already transferred under the previous rules. The Bridges siblings inherited their home in 2009, well before the reform. Their tax basis remained intact.

Cashing Out

Despite the locked-in tax rate, but possibly due to some unwanted attention after the Bridges siblings became the poster children of the two-tiered system, in July 2024, Lloyd, Beau, and Lucinda decided it was time to cash out. They listed the home for $9.2 million. Here is a video tour from when it was first put up for sale:

They did not get any buyers, so on January 7, 2025, they re-listed the property at a reduced price of $8.85 million. Unfortunately, January 7, 2025, also turned out to be the day the Palisades Fire broke out. That fire destroyed the home.

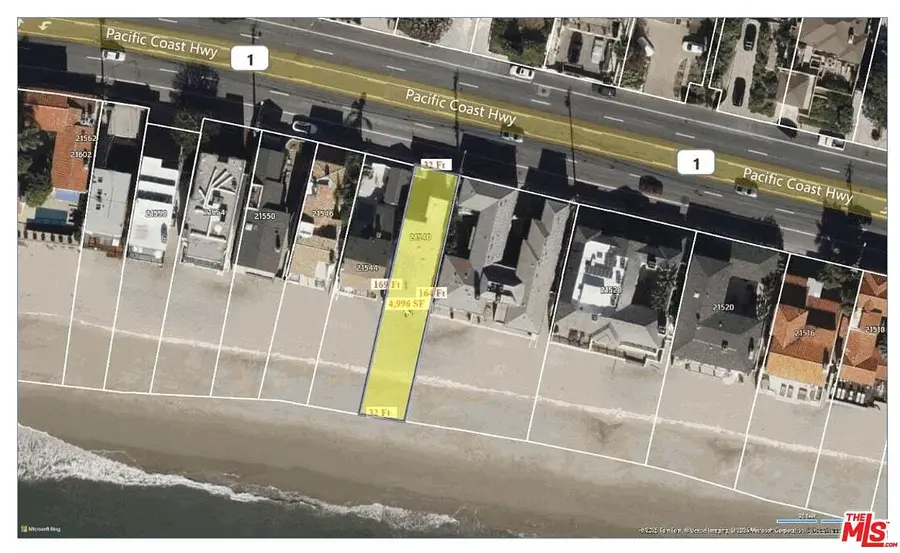

Fast forward a little more than a year, and the cleared parcel is back on the market for $4.37 million.

What A New Owner Would Face

Now consider the math for a hypothetical buyer.

Assume someone purchases the burned lot for $4 million.

High-end coastal construction in Malibu can easily run $2,000 per square foot, especially given stricter modern building codes, coastal permitting requirements, and fire-resistant standards. Rebuilding a 3,000-square-foot home would likely cost around $6 million.

That puts the all-in investment at roughly $10 million.

Because this would be new construction, not a renovation, the finished home would be reassessed at or near market value. Even assuming a conservative $10 million valuation, the new owner would face a property tax bill of about $100,000 per year under California’s 1% rule. That is nearly 18 times what the Bridges siblings were reportedly paying under their inherited assessment.

Then again, if you’re in a position to pay $10 million to build a home, $100k a year is probably like $20 a year to you and me. So maybe it all works out in the end.

(function() {

var _fbq = window._fbq || (window._fbq = []);

if (!_fbq.loaded) {

var fbds = document.createElement(‘script’);

fbds.async = true;

fbds.src=”

var s = document.getElementsByTagName(‘script’)[0];

s.parentNode.insertBefore(fbds, s);

_fbq.loaded = true;

}

_fbq.push([‘addPixelId’, ‘1471602713096627’]);

})();

window._fbq = window._fbq || [];

window._fbq.push([‘track’, ‘PixelInitialized’, {}]);