Share this @internewscast.com

In a concerted effort to tackle suspected narco-terrorist activities, U.S. and Ecuadorian forces initiated joint operations in Ecuador on Tuesday, as announced by the U.S. Southern Command (SOUTHCOM).

SOUTHCOM emphasized its commitment to taking “decisive action” against identified terrorist groups, though details regarding any potential casualties remain unclear.

In a statement shared on X, SOUTHCOM reported, “On March 3, Ecuadorian and U.S. military units commenced operations against Designated Terrorist Organizations within Ecuador. These actions underscore the dedication of our partners across Latin America and the Caribbean to address the threat of narco-terrorism effectively.”

Further highlighting the collaborative initiative, SOUTHCOM remarked, “Together, we are resolutely addressing narco-terrorist threats that have perpetuated fear, violence, and corruption across our hemisphere for too long.”

General Francis L. Donovan, Commander of SOUTHCOM, commended Ecuador’s military for its collaboration with U.S. forces in these crucial operations.

SOUTHCOM Commander Gen. Francis L. Donovan praised Ecuador’s military for joining the U.S. in the operations.

“We commend the men and women of the Ecuadorian armed forces for their unwavering commitment to this fight, demonstrating courage and resolve through continued actions against narco-terrorists in their country,” he said.

The U.S. Embassy in Ecuador said Tuesday the United States “successfully concluded a joint operation” with Europol and Ecuadorian authorities dismantling the Hernán Ruilova Barzola transnational drug trafficking organization, which it said is linked to the Los Lobos cartel.

The announcement follows a series of U.S. strikes targeting suspected drug-trafficking operations in the Caribbean and Eastern Pacific.

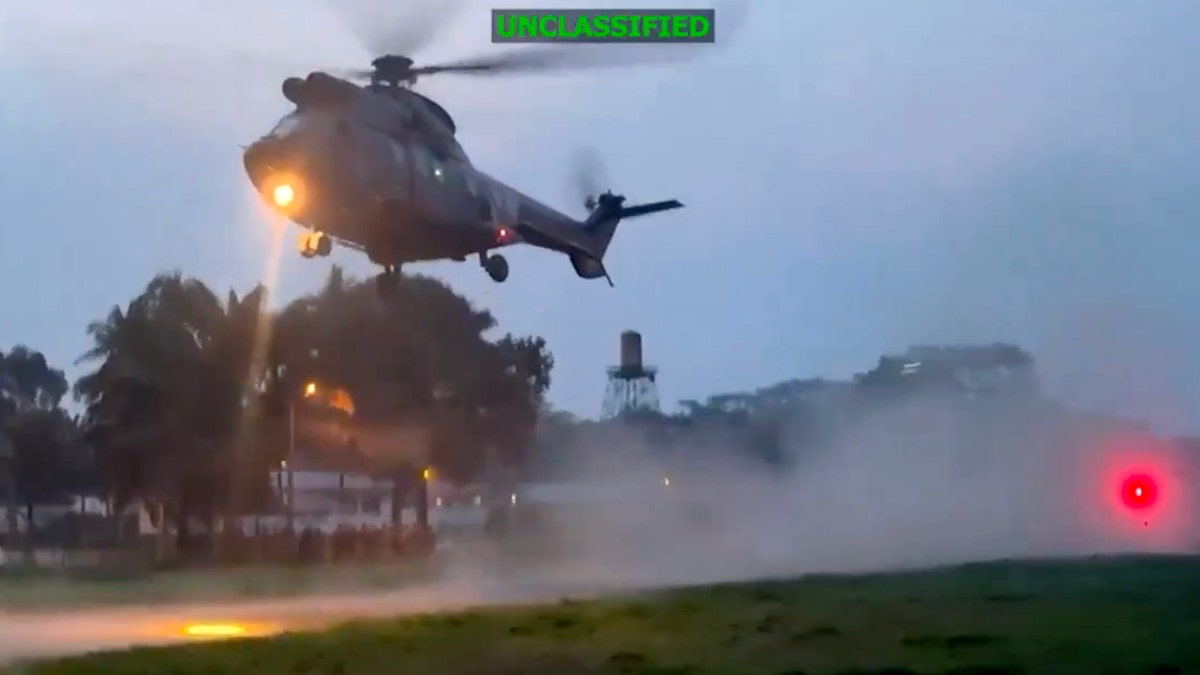

U.S. and Ecuadorian forces launched joint operations Tuesday targeting suspected narco-terrorists in Ecuador, according to U.S. Southern Command. (U.S. Southern Command)

Last week, U.S. forces struck a suspected narco-trafficking vessel in the Caribbean tied to designated terrorist organizations, killing three suspected traffickers.

That strike came after SOUTHCOM said last month it had carried out three strikes in the Eastern Pacific and Caribbean, killing 11.

U.S. Southern Command announced “decisive action” Tuesday against designated terrorist organizations in Ecuador as part of ongoing counter-narcotics efforts. (U.S. Southern Command)

Overall, the U.S. has conducted at least 43 strikes on alleged drug-smuggling vessels, killing 150 people in the Caribbean and Eastern Pacific.