Share this @internewscast.com

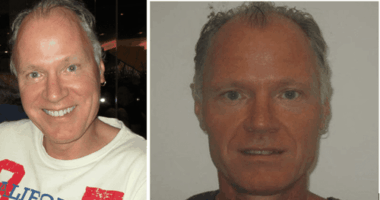

Phil Mazitelli, aged 61, was on the verge of enjoying a dream lifestyle exploring Australia in a caravan.

A cold-call two years ago which convinced him to swap his super has ruined those plans.

“If I make it to 70… that’s probably how long I’ll be working,” he said.

“My life has now changed because I wanted to get away and do stuff, I can’t anymore. It’s had a huge impact.

“At my age I shouldn’t cry but I do, I am angry a lot… now it’s just each day wondering and hoping for a resolution.”

Mazitelli has joined a Facebook group of 1300-strong people who have also lost their superannuation.

Around 12,000 Australians are missing a combined total of $1.2 billion after the collapse of First Guardian and Shield Master Trust.

Members of the group are supporting and counselling each other as the ASIC investigation takes place.

Victims of both collapses are demanding government action – and fast.

“The government needs to intervene now… to safeguard and watch every superannuation fund so that this doesn’t happen to anyone else,” Mazitelli said.

“We are all just normal and hardworking Australians who did nothing wrong.”

Hundreds of victims have lodged complaints with The Australian Financial Complaints Authority (AFCA).

Mazitelli has contacted his local member Andrew Wilcox, the MP for Dawson in north Queensland, who said he will advocate on his behalf.

A Change.org petition has also been started to ask the government to establish a victims’ trust.

ASIC has an ongoing investigation in relation to First Guardian Master Fund and Falcon Capital.

In April, following concerns highlighted by ASIC, the Federal Court designated liquidators for Falcon Capital and mandated the dissolution of First Guardian along with its associated funds.

The court also restrained David Anderson, a director of Falcon, from dealing with his assets and appointed a receiver to his personal property.

ASIC’s inquiry suggests that prospective clients were contacted and directed to personal financial advisors who recommended transferring their superannuation assets into a retail choice superannuation fund, followed by investing part or all of their superannuation into First Guardian.

Although ASIC’s investigation is still underway, the Federal Court has issued interim travel restriction orders against Falcon Capital director David Anderson upon ASIC’s request. The Court also imposed interim orders to freeze the assets of fellow Falcon director Simon Selimaj and constrained his travel.

These orders will be in effect until 27 February 2026. We recognize the circumstances surrounding First Guardian are unsettling for those impacted, and it is one of ASIC’s primary objectives to examine what has occurred and to retain as much of investors’ funds as possible while the investigation proceeds.

To date, ASIC has participated in over 40 court sessions concerning issues related to First Guardian and Shield. We have executed a variety of enforcement actions in regard to these issues, including:

-

stop orders to prevent ongoing consumer harm,

-

commencing court proceedings to preserve assets and restrict travel of persons of interest,

-

appoint receivers and liquidators with the aim of securing investor funds

-

executing numerous search warrants with the assistance of the Australian Federal Police.

-

cancelled licences and banned certain financial advisers.

Readers seeking support can contact Lifeline on 13 11 14 or beyond blue on 1300 22 4636.