Share this @internewscast.com

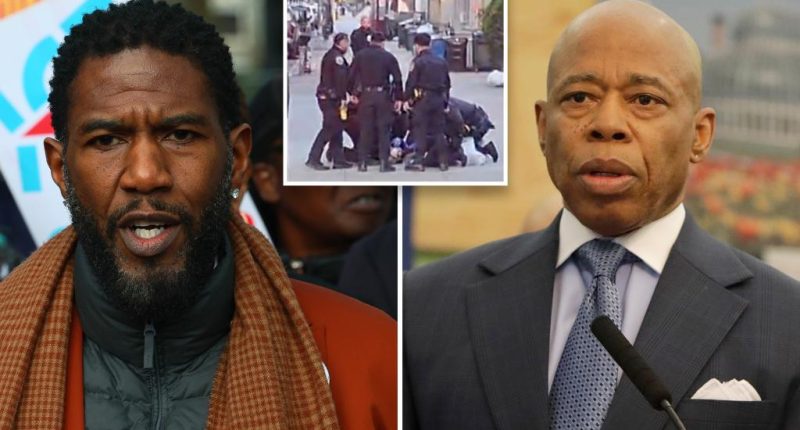

Mayor Eric Adams ripped far-left Public Advocate Jumaane Williams for proposing the state convene a never-used review process to review cops’ fatal shooting of a 61-year-old mentally ill Queens man who lunged at them with a large knife – calling it the latest example of why average New Yorkers say they feel abandoned by Democrats.

“Plans like these are precisely what I, and so many others, mean when saying, ‘the party left working-class people,’” Adams, a Democratic running for re-election as an independent, said in a statement Saturday.

“It doesn’t take a mental health professional to see that their fellow New Yorkers are suffering on our streets and in the subways, but the public advocate’s plan tries to deny what we all are witnessing daily with our own two eyes.”

Williams wrote letters to state and city officials this week noting the state under a decade-old law can convene “mental health incident review panels” in cases like Monday’s fatal shooting to ID systemic failures, but added NYC has never requested such a panel.

However, Adams said “New Yorkers who ride the subway or walk our streets can plainly see and feel that the solution to the mental illness crisis isn’t more government bureaucracy.”

“Convening a panel to review every episode of severe mental illness in our city is purposefully neglectful and denies urgently-needed care to those in desperate need of it,” he added.

Williams’ request comes as Adams is trying to convince Albany pols to expand the city’s powers to involuntarily remove mentally ill people from public spaces and bring them to hospitals.

“New Yorkers with SMI [serious mental illness] are in dire need of treatment, yet often refuse it because they are too sick to know they need help,” said Adams.

“We must change that culture, clarify our policies, and rewrite the law — that’s why, for years, I’ve been calling for common-sense reforms to our state mental health laws to focus on action, care, and compassion.

“The public advocate can discuss that at his next panel, while we continue our work on the streets and in the subways saving lives.”

NYPD brass have defended the cops in the shooting, saying they were forced to defend themselves against the blade-wielding man.

Reps for Williams did not return messages.