Share this @internewscast.com

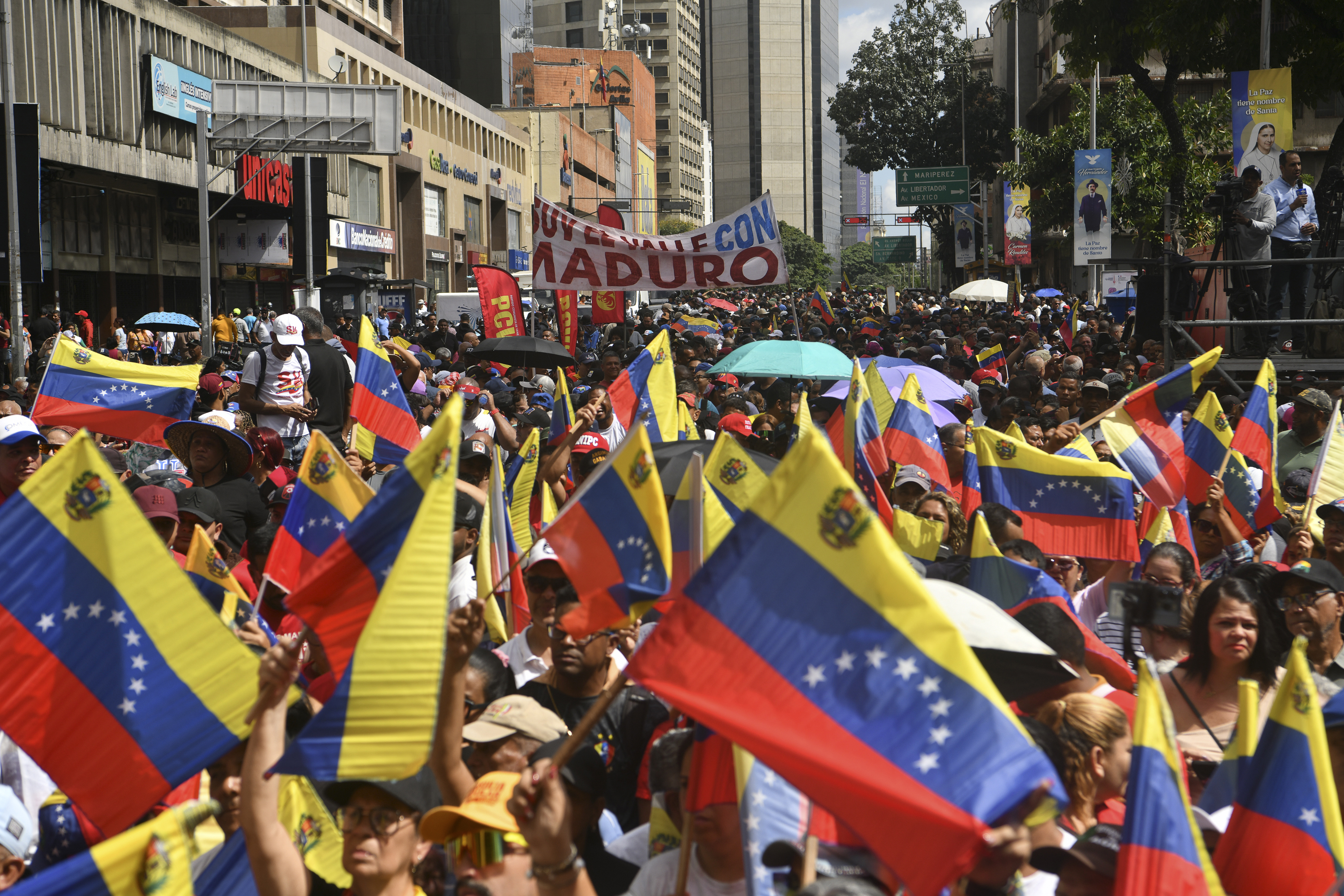

The recent ousting of President Nicolas Maduro has cast a spotlight on Venezuela’s debt crisis, marking it as one of the globe’s most significant unresolved sovereign defaults.

Venezuela’s economic woes, compounded by U.S. sanctions that blocked access to international capital markets, led to a default in late 2017. This default occurred after the government and its state oil company, Petroleos de Venezuela (PDVSA), failed to make payments on international bonds.

Since defaulting, the accumulation of interest and various legal claims, including those related to previous expropriations, have expanded the total external debt well beyond the original bond values.

READ MORE: Marco Rubio disputes US role in Venezuela despite Trump’s remarks

Venezuela’s troubled debt has seen increased interest since President Donald Trump took office in January 2025. Speculators are hopeful for political shifts that could impact the debt situation.

Here’s an overview of the entities involved, potential restructuring options, and who might be seeking repayment from Caracas.

How much does Venezuela owe?

Analysts estimate that Venezuela has about $60 billion (approx. $A89.7 billion) of defaulted bonds outstanding.

However, total external debt including PDVSA obligations, bilateral loans and arbitration awards stand at roughly $150-$170 billion, depending on how accrued interest and court judgments are counted, according to analysts.

The International Monetary Fund estimates Venezuela’s nominal GDP at about $82.8 billion for 2025, implying a debt-to-GDP ratio of between 180-200 per cent.

A PDVSA bond originally maturing in 2020 was secured by a majority stake in US-based refiner Citgo, which is ultimately owned by Caracas-headquartered PDVSA.

Citgo is an asset now at the centre of court-supervised efforts by creditors to recover value.

READ MORE: Tears of joy as millions celebrate Maduro’s downfall

Who holds what?

Years of sanctions, including a prohibition on trading Venezuela’s debt, have made it hard to keep tabs on ownership.

The largest share of commercial creditors likely consists of international bondholders, including specialist distressed-debt investors, sometimes called vulture funds.

Among the creditors is a group of companies awarded compensation through international arbitration after assets were expropriated by Caracas.

US courts have upheld multi-billion-dollar awards to ConocoPhillips and Crystallex among others, turning those claims into debt obligations and allowing creditors to pursue Venezuelan assets to make themselves whole.

A growing pool of court-recognised claimants is competing for recovery from Citgo’s parent company through US legal proceedings.

A Delaware court registered about $19 billion in claims for the auction of PDV Holding, Citgo’s parent, which far exceeds the estimated value of Citgo’s total assets.

PDV Holding is PDVSA’s wholly-owned subsidiary.

Caracas also has bilateral creditors, primarily China and Russia, which extended loans to both Maduro and his mentor, former president Hugo Chavez.

Precise numbers are hard to verify since Venezuela has not published comprehensive debt statistics in years.

READ MORE: ‘What next?’: Fury, chaos as Venezuelans grapple with future after Maduro’s capture

A distant restructuring?

Given the plethora of claims, legal proceedings and political uncertainty, a formal restructuring is expected to be complex and lengthy.

A sovereign debt workout could be anchored by an IMF program setting fiscal targets and debt-sustainability assumptions.

However, Venezuela has not had an IMF annual consultation in nearly two decades and remains locked out of the lender’s financing.

US sanctions are another obstacle.

Since 2017, restrictions imposed under both Republican and Democratic administrations have sharply limited Venezuela’s ability to issue or restructure debt without explicit licenses from the US Treasury.

It is unclear what will happen with US sanctions. For now, President Donald Trump has said the U.S. will “run” the oil-producing nation.

READ MORE: Teenagers as young as 14 among victims of Swiss bar fire

What are recovery values?

Bonds have returned some 95 per cent at the index level in 2025.

Many of them currently trade between 27-32 cents on the dollar, MarketAxess data shows.

Citigroup analysts in November estimated that a principal haircut of at least 50 per cent would be needed to restore debt sustainability and satisfy potential conditions from the IMF.

Under Citi’s base case, Venezuela could offer creditors a 20-year bond with a coupon of around 4.4 per cent, alongside a 10-year zero-coupon note to compensate for past-due interest.

Using an exit yield of 11 per cent, Citi estimates the net present value of the package in the mid-40s cents on the dollar, with recoveries potentially rising into the high-40s if Venezuela were to hand out additional contingent instruments such as oil-linked warrants.

Other investors sketch a wider range. Aberdeen Investments said in September it had initially assumed recoveries of around 25 cents on the dollar for Venezuelan bonds, but that improved political and sanctions scenarios could lift recoveries into the low-to-mid-30s, depending on the structure of any deal and the use of oil-linked or GDP-style instruments.

What is Venezuela’s economic situation?

Recovery assumptions sit against a grim backdrop.

Venezuela’s economy shrank dramatically after 2013 when oil production fell off a cliff, inflation spiraled and poverty surged.

Although output has stabilised somewhat, lower global oil prices and discounts to Venezuela’s crude prices limit revenue gains, leaving little room to service debt without deep restructuring.

The recent US blockade of sanctioned oil tankers has exacerbated the situation.

Trump said American oil companies were prepared to tackle the difficult task of entering Venezuela and investing to restore production but details and timelines remain unclear.

Chevron is the only American major currently operating in Venezuela’s oil fields.

DOWNLOAD THE 9NEWS APP: Stay across all the latest in breaking news, sport, politics and the weather via our news app and get notifications sent straight to your smartphone. Available on the Apple App Store and Google Play.