Share this @internewscast.com

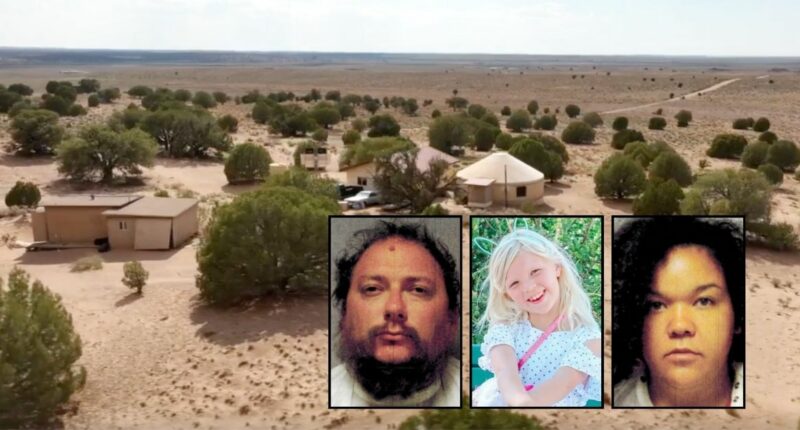

Left inset: Richard Baptiste (Apache County). Center inset: Rebekah Baptiste (GoFundMe). Right inset: Anicia Woods (Apache County). Background: The rural Arizona property where Richard Baptiste and Anicia Woods allegedly subjected Rebekah Baptiste to deadly abuse and punishments (KNXV).

A young girl from Arizona, who tragically passed away following alleged mistreatment by her father and stepmother, reportedly sought refuge by fleeing her home to seek assistance shortly before her demise.

Richard Baptiste and his partner, Anicia Woods, face charges including first-degree murder, child abuse, and child molestation, all linked to the death of Baptiste’s 10-year-old daughter, Rebekah Baptiste. According to Law&Crime, Rebekah passed away on July 28, 2025, just a day after her father and Woods brought her, unresponsive, to a remote medical facility in Arizona’s Apache County. Medical professionals determined her death resulted from “non-accidental trauma,” leading to the immediate arrest of Baptiste and Woods the following day.

On December 30, 2025, the Phoenix Police Department disclosed a report from October 2024, unveiling details of Rebekah’s attempt to find help from strangers after escaping her home months before her death.

The October 2024 incident was referenced in court documents reviewed by Law&Crime, which indicated that Rebekah had “run away” multiple times, according to accounts from Baptiste and Woods. The Phoenix Police Department’s report, accessed by local media, shed more light on the troubling incident.

According to local CBS outlet KPHO, police were dispatched on October 17, 2024, following a notification from Phoenix Children’s Hospital. Rebekah had sought help at a gas station, telling a clerk she was being mistreated by her stepmother. The report states Rebekah informed an officer that Woods had struck her on the hands and feet with a brush.

During a September 2025 court session, Apache County Sheriff’s Office investigator Kole Soderquist revealed Rebekah had leaped from a second-story window to escape. Before reaching the gas station, she encountered a homeless individual and pleaded for assistance, according to Soderquist. When questioned, Baptiste and Woods claimed Rebekah’s wounds were self-inflicted, leading to the closure of the child abuse investigation.

Law&Crime previously reported that teachers alerted authorities to potential child abuse against Rebekah and her two siblings several times before the girl died. The two other children reportedly changed their stories to protect Baptiste and Woods, according to prosecutors. All the children complained to teachers that Baptiste and Woods would allegedly punish them with “physical discipline of laps and planks, and not being fed.” The teachers noticed visible “marks, scratches, or bruises” on all the children.

At the time of their arrest, Baptiste and Woods were being investigated for an alleged incident in May 2025.

Baptiste and Woods are both charged with first-degree murder, child abuse, and child molestation. They are currently awaiting trial in Apache County.