Share this @internewscast.com

(The Hill) Support for providing immigrants living in the country illegally with a pathway to legal status in the U.S. has increased over the past six months, according to a new Quinnipiac University poll.

In the latest poll, conducted earlier this week, registered voters were asked if they “had to choose” whether they prefer giving a pathway to legal status or deporting most immigrants who don’t have legal permission to live in America.

Today, 64 percent say they prefer giving a path to legal status, while 31 percent prefer deportation, and 5 percent don’t know or didn’t answer.

That’s a significant change from a poll conducted in December, when 55 percent supported providing a pathway to legal status, 36 percent preferred deportation, and 9 percent didn’t know or skipped the question.

The overall uptick in support for a path to legal status is driven largely by an increase in support among Republicans and independents.

Among Republicans, support today for a pathway to legal status is at 31 percent a 9-point increase from six months ago. A majority, at 61 percent, still prefer deportation down from 69 percent in December.

Among independents, support for a path to legal status is at 71 percent, up 14 points from December, when 57 percent preferred that option. Today, 24 percent prefer deportation, down from 33 percent in December.

Democrats have stayed largely consistent. Today, 89 percent prefer a pathway to legal status, up 2 points from December; support for deportation remains unchanged at 8 percent.

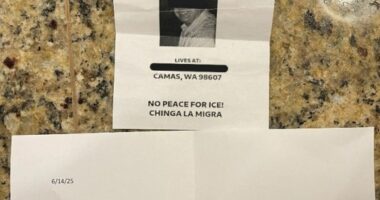

The poll comes as President Trump has cracked down on immigration enforcement during his first six months in office, emphasizing his push toward mass deportations a goal that has galvanized many Democrats to protest while satisfying many Republicans who see the president fulfilling a core campaign promise.

The survey was conducted from June 22-24 and included 979 self-identified registered voters, with a margin of error of 3.1 percentage points.