Share this @internewscast.com

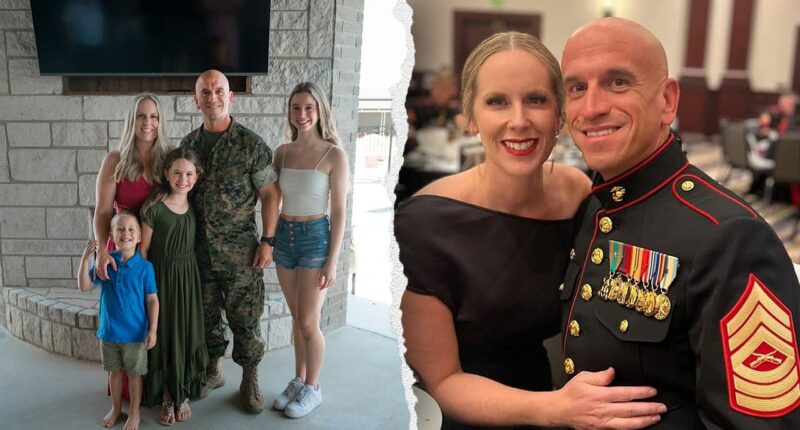

Master Sgt. Ogasian has served in the Marine Corps for over 20 years. (Courtesy of Sarah Ogasian)

The Military Spouses Residency Relief Act provides the same protection to military spouses, allowing them to claim the servicemember’s home state for tax purposes, even if they have employment in the state where they are stationed.

Capital One, the family’s banking institution, informed Fox News Digital that it has adhered to all relevant laws and highlighted its dedication to respecting the SCRA. However, the company chose not to discuss the Ogasians’ account specifically.

“Capital One is committed to both the letter and spirit of the SCRA. We offer benefits and protections that exceed SCRA requirements in some instances that involve a Capital One loan or liability,” said a spokesperson for Capital One. “Additionally, we comply with any relevant federal or state legislation regarding levy orders.”

The family was flagged by New York because they had a state mailing address but were not submitting state taxes. Yet, Jon’s W-2s and military documents clearly identified New Hampshire as his legal domicile, providing him exemption under federal law.

According to Sarah Ogasian, her Marine husband’s W-2s and military records clearly listed New Hampshire as his legal domicile. (iStock)

When the Ogasians called, Sarah said they were shocked to find state officials weren’t familiar with the SCRA protections.

“The New York tax representative was unaware of the Servicemembers Civil Relief Act. My husband had to explain it to him, which I feel is not his responsibility,” she stated. “He shouldn’t have needed to clarify that to a tax representative.”

Sarah mentioned that without access to their savings, her family has been unable to purchase back-to-school clothing, fix their broken van, or cover costs for their children’s sports and dance activities.

“We were starting school here in Texas. We start in the first two weeks of August. We had to sit our kids down and say, ‘listen, we don’t have any money right now,’” she said. “There’s literally no money to be had. We can’t afford school clothes, we can’t afford new backpacks, we can’t afford new shoes. We had to really limit what we got… for the first time in our lives we just had to go out to like secondhand stores and get new clothes that way.”

Master Sgt. Jon Ogasian poses with his wife, Sarah, and their children in front of a Marine Corps aircraft. (Courtesy of Sarah Ogasian)

Sarah points to the years of service and sacrifice their family has given. She worked on the front lines as an ER nurse during the COVID-19 pandemic, while Jon has served 21 years in the Marines, including deployments overseas.

“Back when COVID hit during the pandemic, I was working the front lines in upstate New York. I was the one there watching people die and holding their hands while their loved ones were not there. We were deemed as such heroes back then,” she said. “And now, New York state couldn’t care less about what I’ve done for New York state, never mind my husband, who has served 21 years of his life.”

Fox News Digital reached out to New York Gov. Kathy Hochul’s office and the state Office of the Taxpayer Rights Advocate, but had not received responses at the time of publication.

For now, the Ogasians are left waiting, watching their hard-earned savings remain in limbo.

“People keep telling me ‘sue the state, sue the state.’ And I said, ‘no, I don’t want their money. I just want my money back. The savings we worked hard for are being held hostage from us,'” said Sarah, who offered advice to other military families. “Keep your records. That is the biggest thing as a military family. But also know your rights. Know what the SCRA is. I didn’t know what it was prior to that… stick to your guns.

“When you know that you’ve been wronged, go for it.”